Unlock Fast Cash with Idaho Title Loans in Nampa, Idaho: Your Ultimate Guide

#### Idaho Title Loans Nampa IdahoAre you in need of quick cash to cover unexpected expenses? Look no further than Idaho title loans in Nampa, Idaho. These……

#### Idaho Title Loans Nampa Idaho

Are you in need of quick cash to cover unexpected expenses? Look no further than Idaho title loans in Nampa, Idaho. These loans provide a fast and convenient way to access funds by using your vehicle's title as collateral. In this comprehensive guide, we will explore the ins and outs of title loans, how they work, and why they might be the perfect solution for your financial needs.

#### What Are Title Loans?

Title loans are short-term loans that allow borrowers to secure funds by using their vehicle's title as collateral. This means that you can borrow money based on the value of your car, truck, or motorcycle. The process is typically quick and straightforward, making it an attractive option for those who need cash urgently.

#### How Do Idaho Title Loans Work?

The process of obtaining Idaho title loans in Nampa, Idaho, is relatively simple. Here’s a step-by-step breakdown:

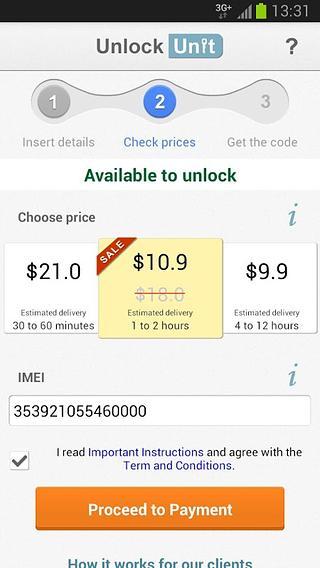

1. **Application**: Start by filling out an online application or visiting a local lender. You’ll need to provide basic information about yourself and your vehicle.

2. **Vehicle Inspection**: The lender will assess the value of your vehicle. This usually involves a quick inspection to determine its condition and market value.

3. **Loan Offer**: Based on the value of your vehicle, the lender will present you with a loan offer. This will include the loan amount, interest rate, and repayment terms.

4. **Documentation**: If you accept the offer, you’ll need to provide the necessary documentation, including your vehicle title, identification, and proof of income.

5. **Receive Funds**: Once everything is approved, you’ll receive your funds, often on the same day. You can use this money for any purpose, whether it’s paying bills, covering medical expenses, or handling emergencies.

#### Benefits of Title Loans in Nampa, Idaho

1. **Quick Access to Cash**: One of the most significant advantages of title loans is the speed at which you can access funds. Unlike traditional loans that may take days or weeks to process, title loans can often be approved within hours.

2. **No Credit Check Required**: Many title loan lenders do not require a credit check, making it easier for individuals with poor credit histories to secure funding.

3. **Keep Your Vehicle**: You can continue to drive your vehicle while repaying the loan, which is a major benefit compared to other types of secured loans.

4. **Flexible Use of Funds**: There are no restrictions on how you can use the money from a title loan, giving you the freedom to address your specific financial needs.

#### Considerations Before Taking Out a Title Loan

While title loans can be beneficial, they are not without risks. Here are some important factors to consider:

1. **High Interest Rates**: Title loans often come with higher interest rates compared to traditional loans. Be sure to understand the total cost of borrowing before committing.

2. **Risk of Losing Your Vehicle**: If you fail to repay the loan, the lender has the right to repossess your vehicle. It’s crucial to have a repayment plan in place.

3. **Loan Amount Limitations**: The amount you can borrow is typically based on the value of your vehicle, which may not cover all your financial needs.

#### Conclusion

Idaho title loans in Nampa, Idaho, can be an excellent solution for those in need of quick cash. With a straightforward application process, quick approval times, and the ability to keep your vehicle, they offer a viable option for many individuals facing financial challenges. However, it’s essential to weigh the benefits against the potential risks and ensure that you have a solid plan for repayment. By doing so, you can take advantage of the financial relief that title loans can provide while minimizing the associated risks.