Understanding Home Equity Loan Percentage: How to Optimize Your Borrowing Power

#### What is Home Equity Loan Percentage?Home equity loan percentage refers to the interest rate charged on a home equity loan, which is a type of loan that……

#### What is Home Equity Loan Percentage?

Home equity loan percentage refers to the interest rate charged on a home equity loan, which is a type of loan that allows homeowners to borrow against the equity they have built up in their property. Essentially, it is a second mortgage that uses the home as collateral. The percentage can vary based on several factors, including the lender, the borrower’s credit score, and the amount of equity available in the home.

#### Why is Home Equity Loan Percentage Important?

The home equity loan percentage is crucial for homeowners looking to leverage their property for additional funds. A lower percentage means lower monthly payments and less interest paid over the life of the loan, making it more affordable for borrowers. Understanding this percentage helps homeowners make informed decisions about whether to take out a home equity loan and how much they can afford to borrow.

#### How is Home Equity Loan Percentage Determined?

Several factors influence the home equity loan percentage:

1. **Credit Score**: Lenders typically offer better rates to borrowers with higher credit scores, as they are considered lower risk.

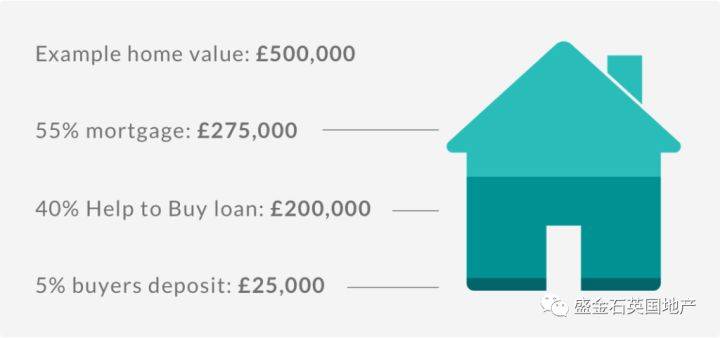

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of the home. A lower LTV ratio often results in a more favorable interest rate.

3. **Market Conditions**: Interest rates fluctuate based on economic factors, including inflation and the Federal Reserve's policies.

4. **Type of Loan**: Fixed-rate home equity loans generally have different percentages compared to variable-rate loans.

#### How to Improve Your Home Equity Loan Percentage

If you’re considering a home equity loan, there are several strategies to improve your chances of securing a lower percentage:

1. **Boost Your Credit Score**: Pay down debts, make payments on time, and avoid new credit inquiries to improve your credit score before applying.

2. **Increase Your Home’s Value**: Consider home improvements that can increase your property’s value, thereby increasing your equity and potentially lowering your LTV ratio.

3. **Shop Around**: Different lenders offer varying rates, so it’s essential to compare offers from multiple financial institutions to find the best deal.

4. **Consider a Co-Signer**: If your credit score is not ideal, having a co-signer with a better credit history can help secure a lower percentage.

#### Conclusion

Understanding the home equity loan percentage is vital for homeowners looking to tap into their home’s equity. By knowing how this percentage is determined and what factors influence it, borrowers can take steps to improve their chances of securing a favorable rate. Whether you’re looking to finance home improvements, consolidate debt, or cover unexpected expenses, being informed about your options can lead to better financial outcomes. Always consult with a financial advisor or mortgage specialist to explore the best strategies for your unique situation.