"Maximize Your Savings with the Dave Ramsey Auto Loan Calculator: A Comprehensive Guide to Smart Car Financing"

---#### Introduction to Dave Ramsey Auto Loan CalculatorThe **Dave Ramsey Auto Loan Calculator** is an invaluable tool for anyone looking to make informed d……

---

#### Introduction to Dave Ramsey Auto Loan Calculator

The **Dave Ramsey Auto Loan Calculator** is an invaluable tool for anyone looking to make informed decisions about financing a vehicle. Renowned financial expert Dave Ramsey emphasizes the importance of living within your means and making smart financial choices. This calculator helps you estimate monthly payments, total interest paid, and the overall cost of your auto loan, allowing you to plan your budget effectively.

#### Understanding the Basics of Auto Loans

Before diving into the features of the **Dave Ramsey Auto Loan Calculator**, it's essential to understand the fundamentals of auto loans. An auto loan is a secured loan where the vehicle itself serves as collateral. Lenders typically offer loans for a set term, ranging from three to seven years, with varying interest rates based on your credit score, loan amount, and down payment.

#### How to Use the Dave Ramsey Auto Loan Calculator

Using the **Dave Ramsey Auto Loan Calculator** is straightforward. Here’s a step-by-step guide:

1. **Input Loan Amount**: Enter the total amount you wish to borrow. This should reflect the price of the car minus any down payment.

2. **Interest Rate**: Input the annual percentage rate (APR) that your lender offers. This rate can significantly affect your monthly payments and overall loan cost.

3. **Loan Term**: Choose the duration of the loan in months. Common terms include 36, 48, and 60 months.

4. **Calculate**: After entering the required information, click the calculate button. The tool will provide you with an estimate of your monthly payment, total interest paid over the life of the loan, and the total cost of the loan.

#### Benefits of Using the Dave Ramsey Auto Loan Calculator

1. **Budget Planning**: The calculator allows you to see how different loan amounts and interest rates affect your monthly budget. This insight can help you avoid overextending your finances.

2. **Debt-Free Living**: Following Dave Ramsey's principles, using this calculator can guide you towards making choices that align with a debt-free lifestyle. It encourages you to save for a larger down payment to reduce your loan amount, thus lowering your monthly payments.

3. **Comparison Shopping**: By adjusting the interest rate and loan term, you can compare different financing options and choose the one that best fits your financial situation.

4. **Financial Awareness**: Understanding the total cost of your loan, including interest, can help you make more informed decisions about purchasing a vehicle.

#### Tips for Using the Dave Ramsey Auto Loan Calculator Effectively

- **Research Interest Rates**: Before using the calculator, research current interest rates for auto loans. This information will help you input realistic numbers into the calculator.

- **Consider Your Budget**: Ensure that the monthly payment fits comfortably within your budget. Ramsey advises that your car payment should not exceed 15% of your monthly take-home pay.

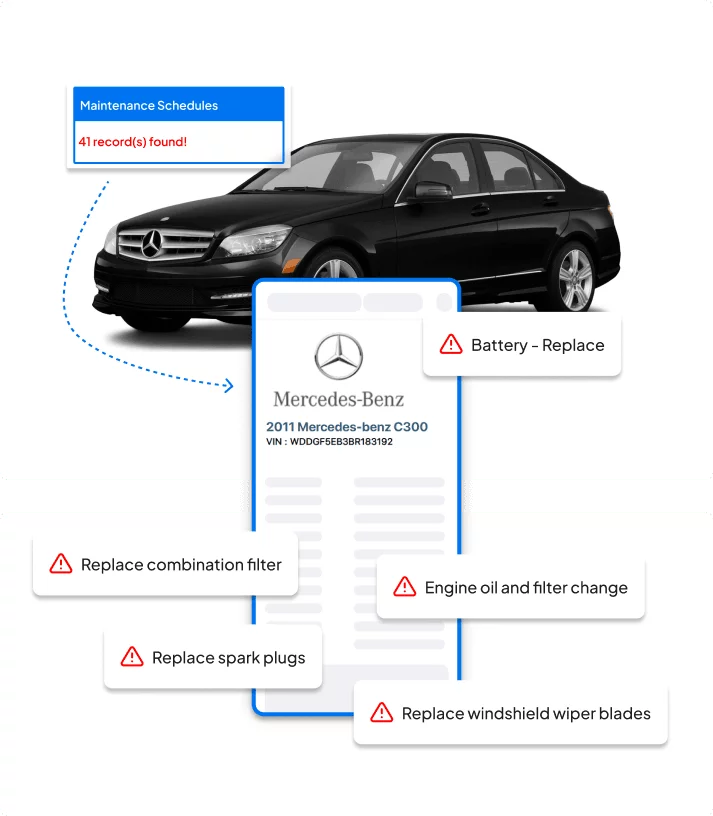

- **Plan for Additional Costs**: Remember that owning a car involves more than just loan payments. Factor in expenses like insurance, maintenance, and fuel when budgeting.

#### Conclusion

The **Dave Ramsey Auto Loan Calculator** is a powerful resource that empowers individuals to make smart financial decisions regarding vehicle financing. By understanding how to use this tool effectively, you can take control of your auto loan, avoid unnecessary debt, and work towards a more financially stable future. Whether you’re buying your first car or upgrading to a new one, this calculator can guide you in making choices that align with your financial goals.