"Ultimate Guide: How to Pay Loan with Credit Card for Maximum Financial Flexibility"

Guide or Summary:Understanding the ProcessMethods of PaymentBenefits of Paying Loans with a Credit CardRisks and Considerations#### How to pay loan with cre……

Guide or Summary:

- Understanding the Process

- Methods of Payment

- Benefits of Paying Loans with a Credit Card

- Risks and Considerations

#### How to pay loan with credit card

Paying a loan with a credit card can be a strategic financial move if done correctly. Many individuals find themselves in situations where managing multiple debts becomes overwhelming, and leveraging a credit card can provide some relief. However, it’s essential to understand the implications and potential risks involved. This guide will delve into the various methods, benefits, and considerations of paying loans with a credit card.

Understanding the Process

To begin with, the first step in learning how to pay a loan with a credit card is to check whether your lender accepts credit card payments. Not all lenders allow this method, so it’s crucial to confirm their policies. If they do accept credit card payments, you can proceed to the next steps.

Methods of Payment

There are several methods to pay your loan using a credit card:

1. **Direct Payment via Lender**: Some lenders may allow direct payments using a credit card through their online portal. This is the simplest method, as it directly links your credit card to your loan account.

2. **Third-Party Payment Services**: If your lender does not accept credit cards, you can use third-party services like Plastiq. These services allow you to pay your loan using a credit card, and they will send a check or electronic payment to your lender on your behalf. However, be aware that these services often charge a fee, typically around 2.85%.

3. **Cash Advance**: Another method is to take a cash advance from your credit card and use that cash to pay your loan. However, this option usually comes with high-interest rates and fees, making it less desirable.

Benefits of Paying Loans with a Credit Card

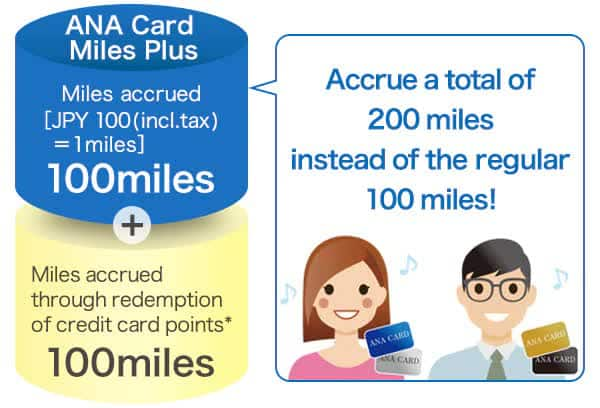

1. **Rewards and Cash Back**: If your credit card offers rewards or cash back, paying your loan with it can help you earn points, which can be beneficial in the long run.

2. **Improved Cash Flow**: Using a credit card can provide temporary relief by extending your payment timeline, giving you more time to manage your finances.

3. **Credit Score Impact**: If you’re struggling with your loan payments, paying with a credit card can help you avoid late fees and negative impacts on your credit score.

Risks and Considerations

While there are benefits, there are also significant risks to consider:

1. **High-Interest Rates**: Credit cards typically have higher interest rates compared to loans. If you cannot pay off the balance quickly, you may end up paying more in interest.

2. **Debt Cycle**: Relying on credit cards to pay off loans can lead to a cycle of debt, where you accumulate more debt without a clear plan to pay it off.

3. **Fees**: Be aware of any transaction fees associated with using a credit card for loan payments, as these can add up quickly.

In conclusion, learning how to pay a loan with a credit card can be a viable option for managing your finances if approached with caution. Always assess your financial situation, weigh the pros and cons, and consider alternatives before proceeding. If you decide to go this route, ensure you have a plan to pay off the credit card balance as soon as possible to avoid high-interest charges. By understanding the process and being mindful of the risks, you can make informed decisions that align with your financial goals.