Understanding Your Options: Can You Pay Off Personify Loan Early?

Guide or Summary:IntroductionWhat is Personify?Can You Pay Off Personify Loan Early?Benefits of Paying Off Loans EarlyConsiderations Before Paying Off Early……

Guide or Summary:

- Introduction

- What is Personify?

- Can You Pay Off Personify Loan Early?

- Benefits of Paying Off Loans Early

- Considerations Before Paying Off Early

- How to Pay Off Your Personify Loan Early

### Translation: Can you pay off Personify loan early

Introduction

In today's financial landscape, many borrowers are seeking ways to manage their debts more effectively. One common question that arises is, can you pay off Personify loan early? Understanding the implications and benefits of paying off loans ahead of schedule can significantly impact your financial health. This article will explore the options available to borrowers, the potential advantages of early repayment, and the considerations to keep in mind.

What is Personify?

Personify is a financial technology company that offers personal loans to consumers. These loans can be used for various purposes, including debt consolidation, home improvements, or unexpected expenses. Like many lending institutions, Personify provides flexible repayment terms, but borrowers often wonder about the possibility of paying off their loans early.

Can You Pay Off Personify Loan Early?

The answer to the question can you pay off Personify loan early is generally yes. Most lenders, including Personify, allow borrowers to pay off their loans before the scheduled end date without incurring penalties. This flexibility is beneficial for those who may come into unexpected funds or want to reduce their overall interest payments.

Benefits of Paying Off Loans Early

There are several advantages to paying off your Personify loan early:

1. **Interest Savings**: One of the most significant benefits is the potential to save money on interest. Loans accrue interest over time, and by paying off your loan early, you can reduce the total interest paid.

2. **Improved Credit Score**: Paying off debt can positively impact your credit score. A lower debt-to-income ratio and fewer outstanding loans can enhance your creditworthiness.

3. **Financial Freedom**: Eliminating debt can provide peace of mind and greater financial flexibility. Once the loan is paid off, you can redirect those funds toward savings, investments, or other financial goals.

Considerations Before Paying Off Early

While there are many benefits to early repayment, borrowers should consider a few factors before making this decision:

1. **Loan Terms**: Review your loan agreement to ensure there are no prepayment penalties. Although most lenders do not charge these fees, it's essential to confirm.

2. **Emergency Funds**: Ensure you have adequate emergency savings before using extra funds to pay off a loan. It's crucial to maintain financial stability.

3. **Other Debts**: If you have multiple debts, consider whether paying off the Personify loan early is the best use of your resources. It may be more beneficial to focus on higher-interest debts first.

How to Pay Off Your Personify Loan Early

If you decide to move forward with early repayment, follow these steps:

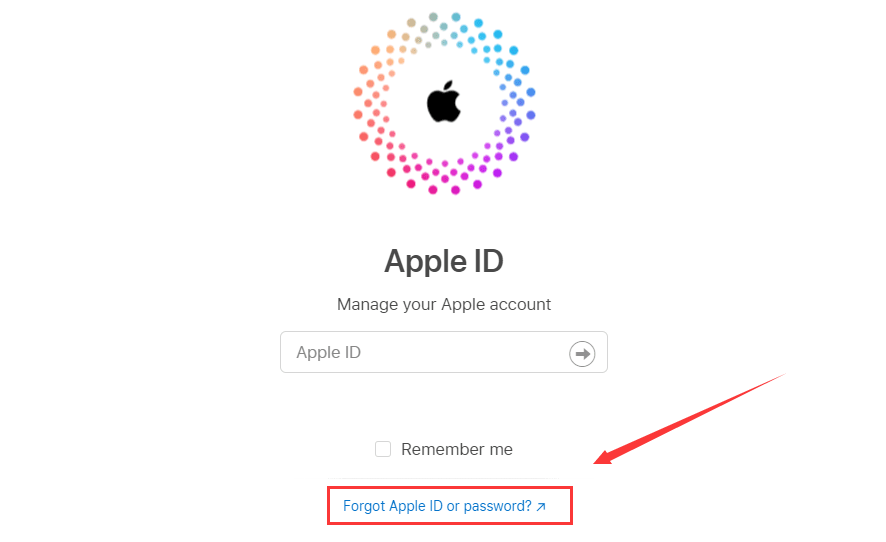

1. **Contact Personify**: Reach out to their customer service to inquire about your current balance and any necessary steps to make an early payment.

2. **Make the Payment**: Use the payment method that works best for you, whether it's online, via phone, or through a mailed check.

3. **Confirm the Payment**: After making the payment, ensure you receive confirmation that the loan has been paid off and request a statement for your records.

In conclusion, the question can you pay off Personify loan early has a positive answer for most borrowers. Paying off your loan early can lead to significant financial benefits, including interest savings and improved credit scores. However, it’s essential to weigh the pros and cons and ensure that early repayment aligns with your overall financial strategy. By understanding your options and making informed decisions, you can take control of your financial future and work towards achieving your financial goals.