Unlocking Savings: The Ultimate Guide to Solar Loans in California

#### Understanding Solar Loans CaliforniaSolar loans in California have become increasingly popular as homeowners seek to harness renewable energy while sav……

#### Understanding Solar Loans California

Solar loans in California have become increasingly popular as homeowners seek to harness renewable energy while saving on electricity costs. These financial products allow individuals to finance the installation of solar panels, making it more accessible for those who may not have the upfront capital to invest in solar energy systems.

#### The Benefits of Solar Loans California

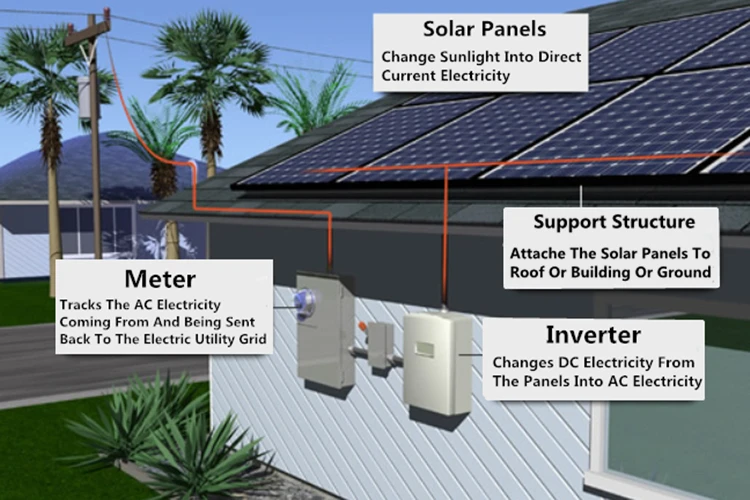

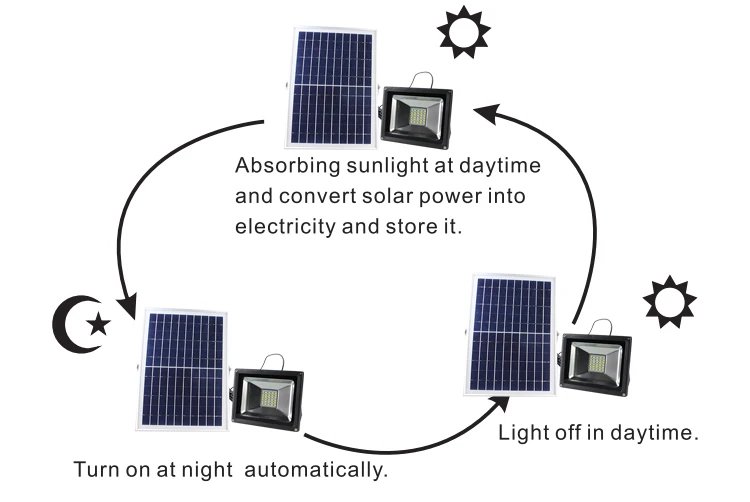

One of the primary advantages of solar loans in California is the potential for significant long-term savings. By investing in solar energy, homeowners can reduce or even eliminate their monthly electricity bills. The state of California, known for its abundant sunshine, provides an ideal environment for solar energy production. With the right solar loan, homeowners can install photovoltaic (PV) systems that convert sunlight into electricity, ultimately leading to lower energy costs.

Additionally, many solar loans come with competitive interest rates and flexible repayment terms. This makes them an attractive option for those looking to invest in solar energy without straining their finances. Moreover, California offers various incentives, such as the California Solar Initiative and federal tax credits, which can further reduce the overall cost of solar installations.

#### Types of Solar Loans California

There are several types of solar loans available in California, each catering to different financial needs and situations.

1. **Secured Solar Loans**: These loans are backed by collateral, such as the homeowner's property. Secured loans typically offer lower interest rates, making them an appealing choice for those with sufficient equity in their homes.

2. **Unsecured Solar Loans**: Unlike secured loans, unsecured loans do not require collateral. They are based on the borrower’s creditworthiness and may come with higher interest rates. However, they provide an option for homeowners who may not have enough equity.

3. **Home Equity Loans and HELOCs**: Homeowners can also consider using home equity loans or lines of credit (HELOCs) to finance their solar installations. These options allow homeowners to borrow against the equity in their homes, often at lower interest rates compared to traditional loans.

4. **PACE Financing**: The Property Assessed Clean Energy (PACE) program allows homeowners to finance solar installations through their property taxes. This innovative approach enables homeowners to pay for solar systems over time, often resulting in no upfront costs.

#### How to Choose the Right Solar Loan California

Selecting the right solar loan in California involves several considerations. Homeowners should assess their financial situation, including credit score, income, and existing debts. This evaluation will help determine which type of loan is most suitable.

It's also crucial to compare different lenders and their offerings. Homeowners should look for competitive interest rates, favorable repayment terms, and any additional fees associated with the loan. Reading customer reviews and testimonials can provide insights into the lender's reliability and customer service.

Furthermore, homeowners should stay informed about the various state and federal incentives available for solar installations. These incentives can significantly reduce the overall cost of solar loans, making it easier to transition to renewable energy.

#### Conclusion: Embrace Solar Loans California for a Sustainable Future

In conclusion, solar loans in California present a viable pathway for homeowners to invest in renewable energy while enjoying substantial savings on their electricity bills. With various financing options available, individuals can find a solution that fits their financial needs. Embracing solar energy not only benefits homeowners economically but also contributes to a more sustainable future for the environment. By taking advantage of solar loans, Californians can lead the way in the transition to clean energy, ensuring a brighter and greener tomorrow.