Do I Have to Pay Back a Subsidized Loan? Understanding the Repayment Process and Options

Guide or Summary:Do I Have to Pay Back a Subsidized Loan?What is a Subsidized Loan?Do I Have to Pay Back a Subsidized Loan After Graduation?Understanding th……

Guide or Summary:

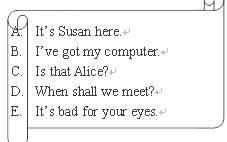

- Do I Have to Pay Back a Subsidized Loan?

- What is a Subsidized Loan?

- Do I Have to Pay Back a Subsidized Loan After Graduation?

- Understanding the Repayment Process

- Interest Rates and Their Impact

- What Happens If You Can't Make Payments?

- Conclusion: Navigating Your Subsidized Loan

Do I Have to Pay Back a Subsidized Loan?

When considering the world of student loans, one of the most common questions that arise is, do I have to pay back a subsidized loan? The answer to this question can be quite nuanced, as it involves understanding the specific terms and conditions associated with subsidized loans, typically offered to undergraduate students with demonstrated financial need. In this article, we will delve into the details surrounding subsidized loans, including repayment obligations, interest rates, and the various factors that may influence your repayment journey.

What is a Subsidized Loan?

A subsidized loan is a type of federal student loan that is designed to help students cover their educational expenses. The key feature of a subsidized loan is that the government pays the interest on the loan while the borrower is in school at least half-time, during the grace period, and during deferment periods. This can significantly reduce the overall cost of borrowing, making it an attractive option for many students.

Do I Have to Pay Back a Subsidized Loan After Graduation?

Yes, you do have to pay back a subsidized loan after you graduate or drop below half-time enrollment. However, the repayment process is structured to be manageable. Borrowers typically have a six-month grace period after graduation, during which they are not required to make payments. This allows graduates some time to secure employment and get their finances in order before beginning repayment.

Understanding the Repayment Process

Once the grace period ends, borrowers will enter the repayment phase. The standard repayment plan for federal student loans, including subsidized loans, spans ten years. Monthly payments are calculated based on the total amount borrowed, the interest rate, and the repayment plan chosen. Borrowers have several repayment options available, including:

1. **Standard Repayment Plan**: Fixed monthly payments over ten years.

2. **Graduated Repayment Plan**: Lower payments that gradually increase over time.

3. **Extended Repayment Plan**: Payments spread over a longer period, typically up to 25 years.

4. **Income-Driven Repayment Plans**: Payments based on income and family size, which can be adjusted annually.

Interest Rates and Their Impact

One of the significant advantages of subsidized loans is the interest rate. Since the government covers the interest while you are in school, borrowers can save a substantial amount over the life of the loan compared to unsubsidized loans, where interest accrues immediately. As of recent years, federal student loan interest rates have been relatively low, making subsidized loans an appealing option for many students.

What Happens If You Can't Make Payments?

Life can be unpredictable, and there may be times when you struggle to make your loan payments. If you find yourself in this situation, it’s crucial to communicate with your loan servicer. They can provide options such as deferment or forbearance, which allow you to temporarily pause payments without damaging your credit score. Additionally, income-driven repayment plans can help lower your monthly payments based on your financial situation.

Conclusion: Navigating Your Subsidized Loan

In conclusion, if you are asking, do I have to pay back a subsidized loan? the answer is yes, but the repayment process is designed to be manageable and flexible. Understanding the terms of your loan, your repayment options, and the support available can make a significant difference in your financial journey. Always stay informed and proactive about your loans to ensure you make the most of your educational investment. By planning ahead and utilizing available resources, you can successfully navigate the repayment process and set yourself up for financial success post-graduation.